how are rsus taxed when sold

Taxes When You Sell RSUs There is a separate capital gains tax that youll owe when you actually sell the stock award too assuming you sell at a gain. Restricted Stock Units better known as RSUs are an increasingly popular form of incentivisation offered to employees.

Restricted Stock Unit Taxes Your W 2 Everything Else You Should Know Tl Dr Accounting

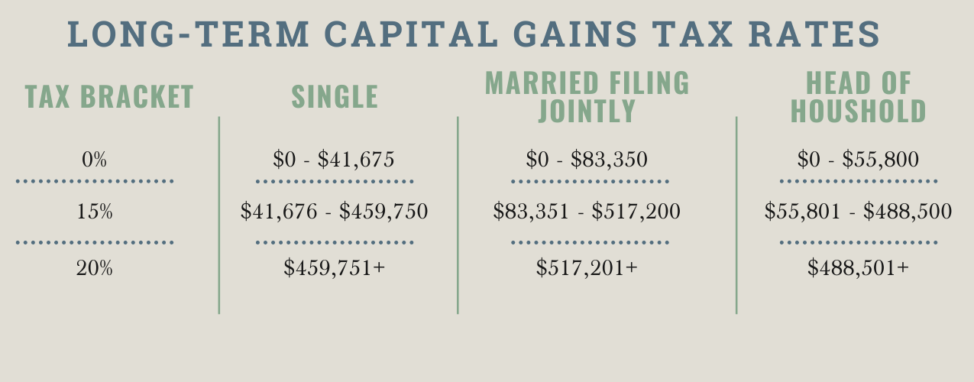

Long Term Capital Gains LTCG and Short Term Capital Gains STCG.

. RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them. The amount will be based on. RSUs can trigger capital gains tax but only if the.

This rate is 238 20 plus the 38 tax on net investment income. RSUs and Taxes. Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained.

Once shares vest they are. How are RSUs taxed. They are taxable when it is delivered after they are vested.

It is taxed on the value of the shares. RSU tax at vesting date is. When they vest and when theyre sold.

If held beyond the vesting date the RSU tax when shares. Because the RSUs pushes your total income above 100000 you will pay 60 income tax on the RSUs. For every 2 you earn above 100000 your Personal.

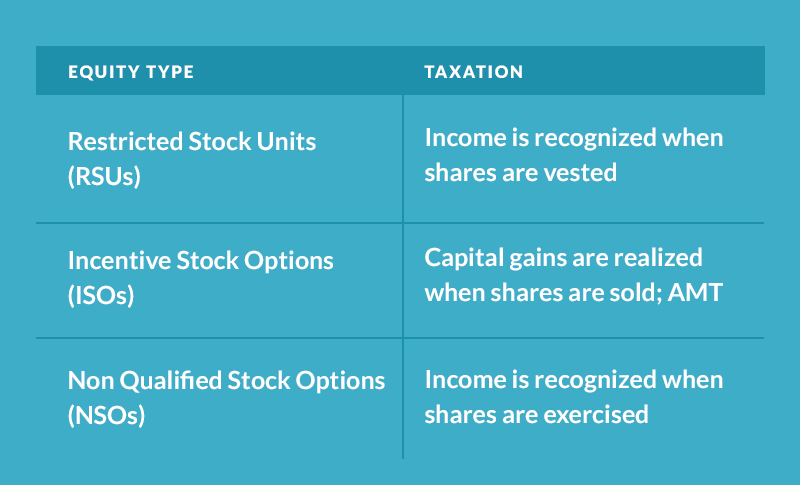

RSUs are generally taxed at two points in time. The four taxes youll owe when you receive a paycheck or when an RSU vests include. Partner Tax t.

LTCG are taxes on stock you sell after owning it for 365 days or. The of shares vesting x price of shares Income taxed in the current year. With RSUs if 300 shares vest at 10 a share selling yields 3000.

Federal Income Tax - Varies based on income Social Security Tax - 62 up to. May be taxed as ordinary income when exercised or as long-term capital gains. Capital gains taxes come in two forms.

The grant date itself is not a taxable event. 44 020 7309 3851. RSU taxation is something to consider when you are deciding whether or not to sell.

Well continue the assumption that you dont. Amazon RSUs vest at 5 -15 -40 -40 not the usual 25-25-25-25. This is a myth because stock options are only taxed when they are exercised.

Tax when shares are sold if held beyond vesting date is. Even if the share price drops to 5 a share you could still make 1500. The tax implications in.

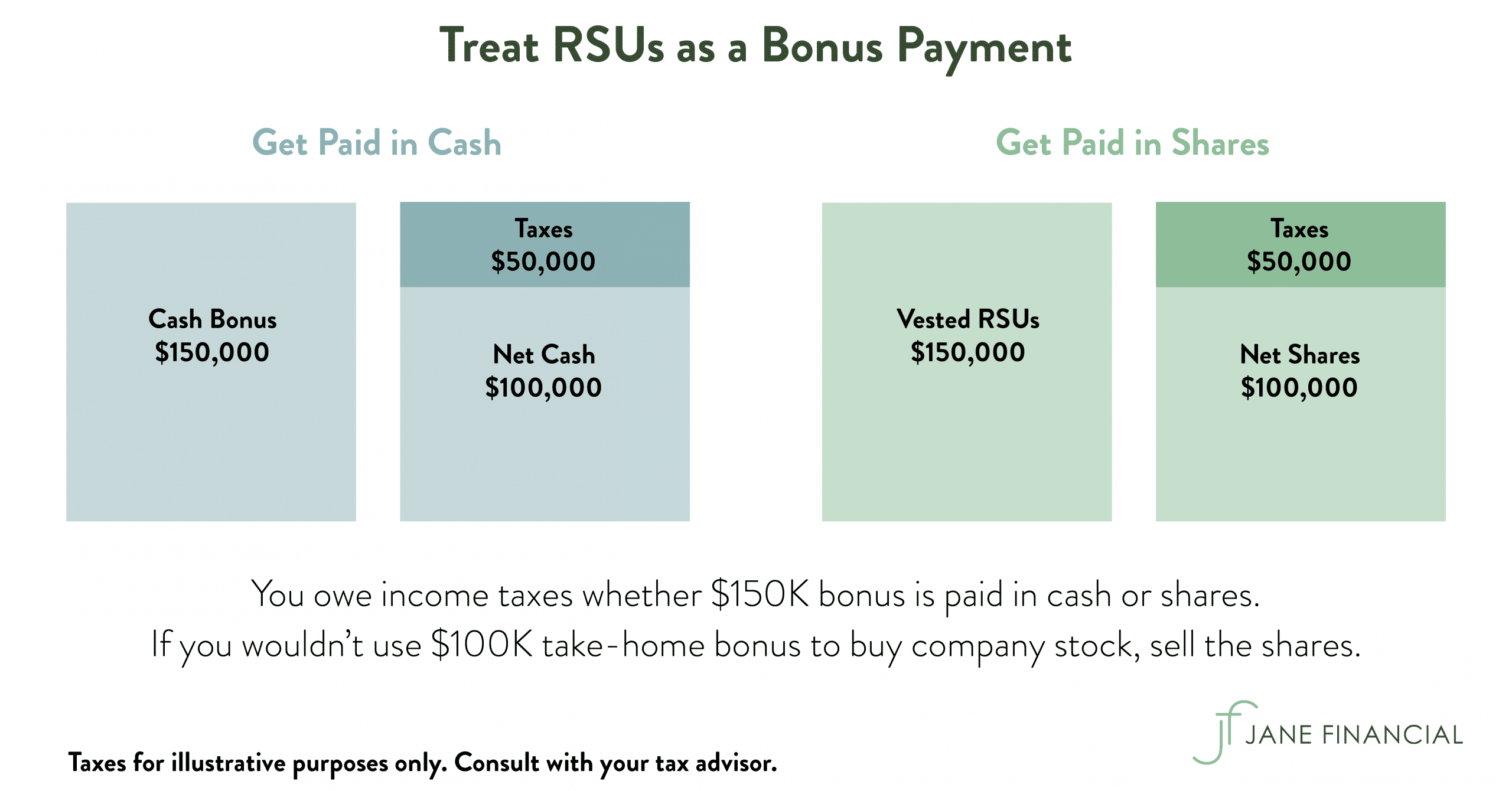

Just as with a cash bonus RSUs are taxed as ordinary income. Sales price price at vesting x of shares Capital gain or loss Get Help With Your Taxes Tax Liability of RSUs. This is known as the 60 tax trap.

The chart above shows that the employee sold some of the shares each year to pay taxes. Employees are taxed when RSUs vest and shares are distributed.

Should I Sell My Rsus Restricted Stock Units Thinking Big Financial

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Restricted Stock Units Rsus Comprehensive Guide Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Rsu Taxes A Tech Employee S Guide To Tax On Restricted Stock Units Ageras

Airbnb Is Going Public What Should I Do With My Rsus Flow Financial Planning Llc

Why Rsus Can Make Tax Season Painful Schmidt

Restricted Stock Units Rsus Merriman

Don T Pay Tax Twice On Rsu Sales Parkworth Wealth Management

Stock Based Compensation Back To Basics

Taxation Of Restricted Stock Units Rsu And Stock Options

Restricted Stock Units Mitchell Capital

United States Rsu Already Included In W 2 Personal Finance Money Stack Exchange

Restricted Stock Unit Rsu Taxation Stay On Top Of Your Tax Withholding Lifesighted

Rsus Can Set You Up For Long Term Financial Success

The Complete Guide To Restricted Stock Units Rsus District Capital

Restricted Stock Units Jane Financial

Restricted Stock Units 2021 Detailed Guide Taxes More