philadelphia transfer tax form

In most cases the buyer will pay 2139 and the seller will pay 2139. The Guide of finalizing Philadelphia Real Estate Transfer Tax Certification - City Of Philadelphia Online.

Cheap Flights To Philadelphia From 32 In 2022 Kayak

Stay away from spending unneeded time use only up-to-date and accurate form templates by US Legal Forms experts.

. Recently taxpayers have taken advantage to substantial discrepancies between assessed and market values to lower realty. REV-183 -- Realty Transfer Tax Statement of Value. INSTRUCTIONS FOR COMPLETING PHILADELPHIA REAL ESTATE TRANSFER TAX CERTIFICATION Section A Correspondent.

Section B Transfer Data. If you take an interest in Fill and create a Philadelphia Real Estate Transfer Tax Certification - City Of Philadelphia heare are the steps you need to follow. PA Realty Transfer Tax and New Home Construction.

Fill Sign Philadelphia Form Transfer Tax 1993. Revenue Code Chapter 91 -- Revenue Code - Chp 91. Wait in a petient way for the upload of your Philadelphia Real Estate Transfer Tax Bcertificationb.

Philadelphias transfer tax is one of the highest rates within Pennsylvania. Is the deed transfer tax exempt. INSTRUCTIONS FOR COMPLETING PHILADELPHIA REAL ESTATE TRANSFER TAX CERTIFICATION Section A Correspondent.

Section B Transfer Data. Enter the date on which the deed or other document was accepted by the Partyies. Each deed requires separate transfer tax checks.

Enter the name address and telephone number of party completing this form. You should be aware that typically there are both state and local transfer taxes associated with this type of transaction in addition to recording fees. Philadelphia transfer tax form real estate.

The consideration is not stated in total on the face of the document it must either be stated or explained on the philadelphia real estate transfer tax certification and state statement of value forms. Hit the Get Form Button on this page. These forms must be fully completed.

Will or Intestate Succession A transfer by will for no or nominal consideration or under the intestate succession laws is exempt from tax. Realty Transfer Tax The Commonwealth of Pennsylvania collects 1 while the City of Philadelphia collects 3278 for a total of 4278. How much are transfer taxes in PA.

We use cookies to improve security personalize the user experience enhance our marketing. State Statement of Value Forms when required. 2 x 100000 2000.

REV-1728 -- Realty Transfer Tax Declaration of Acquisition. Enter the name address and telephone number of party completing this form. Hit the Get Form Button on this page.

Provide the name of the decedent and estate file number in the space provided. Luckily it is customary but not legally required for the buyer and seller to split the transfer taxes evenly. Payment of City Transfer Tax State Transfer Tax and Recording Fees must be made by separate checks.

Consider the transfer tax sometimes known as a tax stamp to be a type of sales tax on real estate. Enter the name address and telephone number of party completing this form. Philadelphia beginning July 1 2017 will begin to tax transfers of interests in real estate entities based on the selling price of the entity rather than the computed value assessed value102 of the realty.

Enter the date on which the deed or other document was accepted by the Partyies. The Philadelphia Real Estate Transfer Tax Certification form is required in duplicate. Ad Download Or Email Form 82-127 More Fillable Forms Register and Subscribe Now.

If you dont have an account yet register. Philadelphia Pennsylvania Realty Transfer Tax Statement of Consideration Download the form youre searching for from your website library. Philadelphia Transfer Tax Exemption.

2 rows When you complete a sale or transfer of real estate that is located in Philadelphia you must. And estate file number in the space provided. Philadelphia transfer tax form real estate.

You can erase text sign or highlight of your choice. REV-715 -- Realty Transfer Tax Monthly Report. For comparison Montgomery County Pennsylvanias transfer tax is only 1.

Ance on the Realty Transfer Statement of Value form. The most secure digital platform to get legally binding electronically signed documents in just a few seconds. Ad Download Or Email Form 82-127 More Fillable Forms Register and Subscribe Now.

Effective october 1 2018 the transfer tax for the city of philadelphia is 3278 with an additional state of pennsylvania tax of 1 for a total of 4278. The state of Pennsylvania charges one percent of the sales price while the municipality and school district each charge one percent of the sales price for a total of two percent ie. Transfer to a Trust A transfer for no or nominal consid-.

Pennsylvania imposes a 1 transfer tax on the value of the real estate being transferred while Philadelphia imposes a 3278 tax on the value of the real estate being transferred. Philadelphia realty transfer tax 12293. Effective October 1 2018 the transfer tax for the city of Philadelphia is 3278 with an additional state of Pennsylvania tax of 1 for a total of 4278.

The correct payees for each are as follows. REV-1651 -- Application for Refund PA Realty Transfer Tax. 2 percent X 100000 2000 in Pennsylvania.

If no sales price exists the tax is calculated using a formula based on the property value determined. Nominal consideration or under the intestate succession. Attach a complete copy of the trust agreement and identify the grantors relationship to each beneficiary.

2 x 100000 2000. If you are curious about Customize and create a Philadelphia Real Estate Transfer Tax Bcertificationb here are the easy guide you need to follow. This transfer tax is traditionally split between the buyer and the seller with each.

Complete the correct certificate and submit it when you record the deed or mail in your realty transfer tax.

Philadelphia Homeowners Apply For These Two Philadelphia Tax Exemption Programs This Weekend

/cloudfront-us-east-1.images.arcpublishing.com/pmn/TZZDO7RSIRG2PEDQSYWI3UY4AI.jpg)

How To Get A Government Id In Philly

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Philly Realty Transfer Tax What Is It And How Does It Work Department Of Revenue City Of Philadelphia

Report Your Arrival In Philadelphia Temple University International Student And Scholar Services

Deciding Where To Retire Affects Both Your Lifestyle And Your Wallet During Retirement Part Of Successfully Planning Your Tax Deductions Tax Refund Tax Return

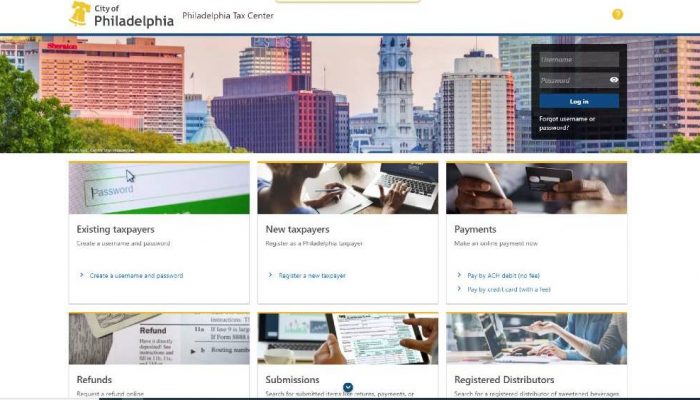

Log In To The Philadelphia Tax Center Today Department Of Revenue City Of Philadelphia

Birt And Npt Philly Business Taxes Explained Department Of Revenue City Of Philadelphia

How Much Does It Cost To Build A House In Philadelphia Home Builder Digest

Coronavirus Bulletin Board Aids Law Project

How To Get A Government Id In Philly

Philadelphia Garlic Herb Cream Cheese Spread 7 5 Oz Tub Walmart Com

Real Estate Transfer Tax In Philadelphia Real Estate Lawyer Pa

Philly Taxes Employer W 2 Submission Simplified Department Of Revenue City Of Philadelphia

Philadelphia Launches New City Tax Site Brinker Simpson

Real Estate Transfer Tax In Philadelphia Real Estate Lawyer Pa

Philadelphia Neufchatel Cheese With 1 3 Less Fat Than Cream Cheese 8 Oz Brick Walmart Com

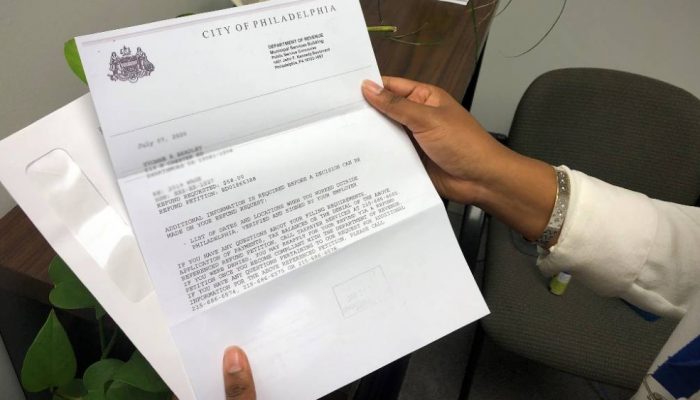

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia